The approach of Interpack, the world’s largest packaging trade show (April 24-30, Düsseldorf, Germany) is a good occasion to ask: What are the major differences between European and American packaging?

A lot of it has to do with the differences between European and American governments.

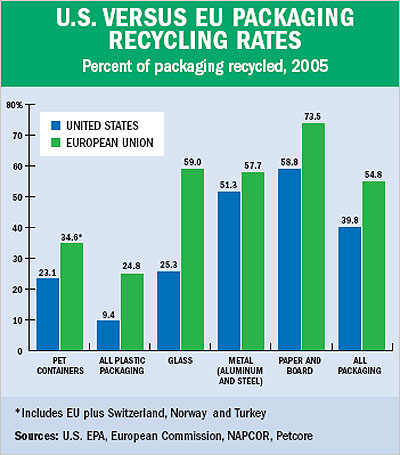

The differences between regulation of packaging waste in the European Union and the United States are probably the single gulf between them in terms of packaging. Some of these differences are narrowing, due to market conditions and other factors; others probably will remain for the foreseeable future.

Paradoxically, the heterogeneous continent of Europe has adopted a much more unified and monolithic approach to packaging issues than the United States. The European Union (EU), the 27-member organization that comprises Europe’s most prosperous nations, adopted in 1994 a directive that continues to guide the collection and disposal of post-consumer packaging (as well as other types). The U.S., on the other hand, has paid virtually no attention to post-consumer packaging regulation on a federal level, preferring to leave the issue in the hands of state and local governments.

Living in harmony

The 1994 EU Directive had two major goals. One was reducing the environmental impact of post-consumer packaging. The other was harmonizing packaging regulations among EU member nations, which fit in with the EU’s general mission of making trade and travel across Europe easier.Specifically, the Directive gave member states the mandate to establish systems to collect used packaging and reuse or recycle as much of it as possible. Most of them incorporated the approach of the Green Dot system in Germany, which had been adopted shortly before. The Green Dot system, named for the logo that appeared on compliant packaging, had as its backbone the principle of “producer pays”-in other words, it’s the responsibility of the company that puts a package into the market to make sure it’s disposed of in an environmentally benign manner.

The EU has picked up this principle. As summarized by Pierre Picot, senior packaging consultant to the International Trade Centre: “The supplier of packaging components, or of packaging accessories, or of packages, is responsible for the conformity of the product he supplies to the user.”

In most cases, the producer pays a fee to have packaging collected and, as far as possible, reused or recycled. Some countries have a central authority that coordinates this collection; others use industry-sponsored organizations, and still others leave it up to private enterprise (usually coordinated by a government agency). The common element is that most EC nations have a uniform system for collecting discarded household packaging.

The United Kingdom is the most prominent exception. The UK determined that it could meet EU goals for recycling and reuse without worrying about primary packaging; instead, it concentrated on reducing and collecting secondary and tertiary or transport packaging. As a result, the UK has no uniform, nationwide system for collecting household packaging.

Instead, the UK uses a system called Producer Responsibility Notes (PRNs). These are tradable permits, somewhat akin to promissory notes, that packagers are issued in proportion to the amount and type of packaging they’ve put into the market. The packagers then pay someone else to take the PRNs off their hands-in other words, to take the responsibility of recycling or reusing all or most of the packaging. The “someone else” may be a disposal firm, or it may be a broker who will then turn around and try to pay a disposal firm to take over the PRN for less money than the broker accepted from the original packager.

Consumers off the hook

What European countries have in common, no matter the details of their packaging-collecting systems, is that consumers are, for the most part, relieved of responsibility, says Julian Carroll, managing director of Europen, a trade group of European packaging producers, users and collectors.“What it’s done is, it’s basically taken the heat off packaging at the consumer level,” Carroll says. “In most countries by and large throughout Europe, it’s no longer an issue.” As the ranks of the EU have swollen since 1994 with new admissions, the new countries have conformed to EU regulations as a condition of joining. Romania, for example, which joined early last year, has instituted a Green Dot system almost identical to Germany’s.

One of the major obstacles to the smooth functioning of the European regulatory system has been a tendency of individual countries to impose regulations that favor their own industries. One of the most notorious was an attempt by Germany to mandate that 80% of its retail beer had to be bottled in refillable containers. This regulation, which would have severely inhibited the ability of other countries to sell beer in Germany, was the subject of a lengthy dispute in the EU administrative courts before it was struck down a few years ago, along with a similar provision in Austria. Ironically, Hungary, which joined the EU in 2005, is currently engaged in a legal dispute with the EU over exactly the same issue.

“There’s this sort of unholy alliance between those who claim it’s for environmental protection and those who want to protect their market share,” Carroll says.

Hands off in U.S.

In the United States, by contrast, the federal government has adopted a hands-off attitude toward regulating package disposal, leaving it mostly up to states and local authorities.The most stringent consumer packaging regulations in the U.S. are mandatory deposit laws, which are in place in 10 states. Under those systems, of course, it’s the consumer who actually pays. The deposit system in California comes closest to European producer-pays systems. In California, consumer-goods manufacturers have to pay recycling fees to the state Department of Conservation. These fees are roughly based on the cost of recycling minus the value of the collected material. Conversely, retailers who accept used packaging and waste haulers who pick it up curbside are eligible for reimbursement from the state.

The lack of a federal standard in the U.S. has left a sort of vacuum, which the private sector has rushed to fill in, most notably with the Wal-Mart sustainability initiative.

The primary difference between the state-based EU system and the Wal-Mart system-and the primary weakness, in Carroll’s view-is that the Wal-Mart system tries to evaluate every environmental aspect of packaging from a limited perspective, and reduce it to a single number.

As Carroll told attendees at the Sustainable Packaging Forum in Pittsburgh last September, “there is no scientific justification for combining LCA [life-cycle analysis] impact categories to derive a single number. It’s difficult to compare apples with oranges. This could only be done by allocating an arbitrary, or at best subjective, weighting to each category, and those weightings would undoubtedly be contested.”

Also, when it comes to recovery value, the Wal-Mart system focuses only on the packaging that remains in Wal-Mart’s custody, excluding the primary packaging taken home by the consumer.

Renewable to come?

In terms of packaging material development for the near future, one potential difference between Europe and America is the development of biodegradable or renewable-resource packaging. Wal-Mart has “renewable packaging” as one of the “Seven R’s” for packaging that it released in late 2006. That has helped jump-start the development of packaging made from corn and other renewable materials in the United States. (See “How to Sustain Green Credentials,” Food & Beverage Packaging, January 2008, p.38.)The EU is seeing similar efforts, but the difference is that the advocates of biopolymers have to go through the EU. Carroll says they’ve been asking for exemption from Green Dot-type fees, mandates that half of all plastic packaging has to contain biopolymers and other special treatment.

More generally, Carroll says, Germany is trying to revise its internal regulations to give preferences to “environmentally favorable” packaging, including biopolymers. “But the decision as to how you qualify as favorable and how you find yourself in the bad-guy camp as unfavorable is not very transparent,” he says. “Moreover, what we’re arguing is that you can’t have a definition in your national legislation which isn’t comparable with what’s in the EU legislation.”

The biggest effect of the EU Directive, in practical terms, is that it tends to buffer consumers from concerns about the environmental impact of packaging.

“Most citizens generally think, well, my waste packaging, yeah, there’s too much of it, and they generally don’t understand why there’s so much of it and the function it does and what benefits it brings them, because industry doesn’t spend enough money telling them that,” he says. “But by and large, it’s taken care of. It’s no longer an issue.”

Consumer concerns span the Atlantic

A Datamonitor study late last year on European consumers’ attitudes toward packaging concluded that they share much the same concerns with Americans. These include:Health and fitness. Consumers want more information about nutrition. A primary concern will be that the information should be easy to assimilate quickly, in terms of either gradated levels (high, medium or low) of key positive and negative nutrients, or percentages of daily requirements.

Freshness. This is a special concern in Europe because the shorter distribution distances (relative to America) mean a greater prevalence of refrigerated foods, which are especially prone to temperature abuse. Time-temperature indicators and intelligent ink are among the technologies that have promise in this regard.

Aging consumers.The report stated that 57% of older consumers are liable to switch products solely based on inconvenient packaging. Ease of opening and handling, appropriate portioning and legibility of all elements of packaging (including date codes) are all important factors.

INTERPACK SET FOR APRIL 24-30 IN DÜSSELDORF

Interpack, the largest packaging show in the world, is set for April 24-30 at the Düsseldorf Fairgrounds in Düsseldorf, Germany.The last Interpack, in 2005, featured more than 2,600 exhibitors and attracted more than 175,000 visitors from 106 countries. The show will be spread across 19 halls at the vast Düsseldorf fairgrounds, including additional space in new hall 8B. This is Interpack’s 50th anniversary, and show officials expect this year’s to be the biggest ever.

A specialized part of Interpack will be Innovationparc Packaging, a pavilion that will expose visitors to interactive solutions that meet the diverse demands of consumers, retailing, logistics and production. The focus will be on innovations in fast-moving consumer goods, with each one presented in the context of the entire, relevant value chain. Included in this holistic concept will also be exhibitors from the raw materials industry, producers of packaging materials, packaging machinery manufacturers and design agencies.

For more information on Interpack, accesswww.interpack.com