That question might have a certain meaning to, say, a political consultant. It has a very different meaning to a consumer packaged goods manufacturer.

The recession has been a dominant feature of the consumer mindset since its inception in 2007. Whether it’s going away is a subject of debate, but there’s very little question that it’s going to have an effect on consumption for the foreseeable future.

But what effect? And how can CPG companies account for it?

One of the first principles to remember is that consumers don’t always respond rationally to various situations. Economic crises are no different.

“Based on some of the research I’ve seen, consumers talk about evaluating brands as part of a logical, comparative-attribute sense,” says Lee Sucharda, president of Design North. “But when they get into the store and there’s this myriad of choices, they tend to either fall back on habits of purchase, or they react more to the emotional quality than the logical quality.”

On the other hand, the need to save is very real, too. The value-conscious nature of today’s consumer, due to the economy, is almost a given.

“I think consumers are becoming a lot more discerning of what they want to spend their money on, and the notion of good value for money and not-so-good value for money is becoming much crisper in their minds,” says Asad Hamid, vice president of global R&D for Campbell Soup Co.

Restaurant trips down

One strong indicator is restaurant attendance, which has been declining throughout the recession. According to statistics from NPD Group, restaurants in the year-ago period ending last spring suffered declines in traffic ranging from 3% for quick-service restaurants to 12% for fine-dining establishments.Packaging that somehow incorporates the restaurant experience, through graphics and/or function, will have an advantage.

“With the eating at home, though, there’s still that desire of having a restaurant experience,” says Peter Clarke, head of design firm Product Ventures. “What we’re finding is that packaging is having to work harder to help.”

When it comes to re-creating the restaurant experience, packaging has to use both form and function, Clarke says. Consumers, in many cases, lack either the skills or the time, or both, to be completely comfortable in the kitchen-a situation that doesn’t change in bad times.

“The packaging, if the graphics, as well as the structure, is designed correctly, gives you kind of step-wise intuitive instructions on how to prepare,” Clarke says. “The consumers are looking [at food] not only to be delicious and healthy, but they’re also looking for it to be efficient, because they’re still time-starved. Packaging can achieve all that. It can make it super-efficient for you to create a restaurant-quality meal, and the quality of the ingredients are maintained via the packaging.”

Frozen foods comprise a natural segment to appeal to those desires. According to ConAgra Foods, frozen items appeared on the dinner table 17% of the time in 2009, up from 13% in 1994. ConAgra has rolled out several new products over the last couple of years, both frozen and dry, that fulfill those roles. Its Healthy Choice Fresh Mixers and Marie Callender’s Home-Style Creations line of dry meals allow pasta or rice to cook and drain in the same container.

Café Steamers from ConAgra are an example of packaging that

helps contribute to a restaurant-style experience.

“We rarely cook from scratch anymore,” says John Plaso, ConAgra’s vice president for business development. “We’re on the move. Double-income families are more prevalent, and people want convenient alternatives that help them produce a family meal.”

Cocoa Via is one of the Mars products that uses design cues to promote the idea of "affordable indulgence."

Priorities

In many cases, the recession is forcing consumers to prioritize which aspects of foods and beverages they most value. One of the biggest such attributes is indulgence, which paradoxically becomes a source of reassurance in bad times.“You would think it might go away when you’re economically stressed, but it actually even becomes more important that you treat yourself,” Clarke says. “It’s like a psychological need to fulfill yourself.” He looks for packaging to fulfill what he calls “the democratization of luxury,” making it affordable and accessible.

“There’s cost effective ways to do that, but you just have to make sure you use the right imagery, and use imagery that’s more sophisticated,” he says. Elements like script-style fonts, deep colors and metallic accents can help. Clarke mentioned Mars Inc. as a company especially adept at this sort of “democratization,” with products like its Dove and Cocoa Via lines.

Campbell's most recent redesign of the labels for its mainstay soups emphasize the product's wholesome nature.

“There seems to be, in many consumers’ minds, a real tension between affordability and nutrition,” Campbell’s Hamid says. “Many of them don’t actually want to trade off nutrition for cheaper products. And so there is a lot of opportunity for people who can actually cater to this desire for affordable nutrition.”

Campbell Soup is well positioned to take advantage of this desire with its main product line. The company recently rolled out a fundamental redesign of its soup labels, featuring graphic elements like a spoon and steam coming from the bowl, to denote the wholesome nature of the product.

“We really took the time to talk to our consumers and understand what was important to them....and really focus those insights into design development,” says Darralyn Rieth, director of global packaging design. “That led us to what we call the joy of soup, the redesigned Campbell Soup label.”

Another instance of developing packaging for “affordable nutrition” came when Campbell rolled out an 8-ounce slim can for its V-Fusion fruit/vegetable juice drink. “What that allows us to do is get into a value proposition that appeals to moms and that got that product into school lunch boxes,” Hamid says. The new can fills the niche for which the 12-ounce can was too big and expensive.

Size matters

Variations in package size, always a critical part of packaging strategy, take on even more significance in bad economic times. Even when the recession fades, consumers may very well stick with the different purchase and usage patterns they learned while it was happening.But what patterns?

Stockpiling with trips to the club store would seem to be an obvious one. But it isn’t necessarily so, Clarke cautions.

“I think there’s actually a lot of wasted product associated with club-store packaging, because the packaging hasn’t been right-sized, it’s just been upsized,” he says. “I’m finding that the really savvy clients are looking at consumption patterns and designing packaging to be in keeping with the frequency that consumers need to replenish their groceries.” One factor working against stockpiling, he says, is the desire for freshness: “This movement toward fresher and less preservatives, too, is also at odds with stockpiling. There’s more just-in-time and more rightsizing...so they’re not creating these situations where [consumers] feel they have to stockpile just to get a deal and they end up with what we call pantry fossils.”

Campbell was reacting to that consideration when it make a change to the club-store packaging for Pace salsa. Pace had previously been sold in 64-ounce plastic jugs, but that was just too big, even for club-store customers, Hamid explains: “Consumers like the value of it, but when they opened it, they couldn’t consume it fast enough, so they had to throw a lot of it away.” Campbell ended up replacing the big jug with two 32-ounce bottles shrink-wrapped together.

Private label grows

Another pattern that may very well persist post-recession is the growth in private label. Supermarket sales of private-label products reached all-time highs last year of 18.7% dollar share and 23.7% unit share, according to the Private Label Manufacturers Association (PLMA). Store brands accounted for almost 90% of all new supermarket revenue.Food and beverage retailers, and the manufacturers who supply them with store brands, have laid the groundwork for years by raising their standards for private-label packaging. In many cases, it’s not only as attractive as national-brand packaging; it’s as subtly nuanced, appealing to different financial concerns (such as economy or “affordable indulgence”).

“Private label has enabled consumers to be comfortable about trading down to less expensive alternatives because they’ve upped their game,” Clarke says.

PLMA president Brian Sharoff points out that consumers are used to a fairly high level of packaging in general. “American consumers are not used to dull packaging,” he says. “Any retailer that wants to bring customers from national brands to store brands has to provide the consumer with an exciting, enticing packaging experience.”

Sharoff estimated that only about up to 15% of consumers are suffering actual financial hardships, and perhaps another 25% are worried by the threatening economy without having yet suffered any actual harm. “When even a small slice of consumers are susceptible, packaging is more important than ever before,” he says.

The worst economic downturn since the Great Depression has taught consumers some habits that will persist into recovery. Packagers who appeal to those habits will ensure that their own prosperity will grow with the country’s.

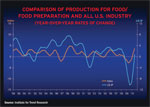

Source: Institute for Trend Research

Recovery is 'mild' but real: Economist

The U.S. economy is in a sustainable recovery, which is “mild” but will last through 2012, economist Alan Beaulieu told the PMMI Annual Meeting in Greenville, S.C.Beaulieu, president of the Institute for Trend Research, gave his forecast in what is becoming an annual tradition for PMMI. His message was one of restrained optimism.

“This is a sustainable economic recovery. There will be no double dip,” Beaulieu said to applause and cheers from the audience of about 150. “If you’re making money now you’re going to continue to make money, you’re going to be continue to be profitable. The U.S. economy is not going to fall into the abyss.”

Beaulieu said job creation trends are encouraging. “In five out of the last six months, we’ve created jobs in the private sector in the United States,” he says. “You’re going to see the economy pick up more steam, but that’s founded on the employment numbers, not the unemployment numbers.”

He identified “uncertainty” as one of the main obstacles to business investment, especially political uncertainty. “When you’re dealing with uncertainty, you say to yourself, ‘Do I really want to hire a lot of people when I don’t know what health care reform is going to do to me, or when I don’t know what kind of taxes I’m going to be facing?’” He went on to say that this kind of political uncertainty should abate after the midterm elections-regardless of the results.

Beaulieu touched on the economic prospects of various business sectors, including food and beverages. “If you’re participating in the food segment, these are happy days-with slower growth, but happy days,” he said. Food and foodservice production is showing positive growth rates that outpace U.S. industrial production as a whole. He noted that beverages were also above year-ago levels, though he questioned the notion that beverages are counter-cyclical when it comes to resisting economic downturns: “A lot of studies show that’s really kind of a questionable outlook.”