Kraft revenue up, but earnings down

Frito-Lay downsizes products, raises prices

Carbon footprint leaving marks

Ragú moves into single-serve pouches

Cool Whip moves into aerosol cans

by Pan Demetrakakes

Executive Editor

Packaged foods, both private label and branded, are holding their own despite-or perhaps partially because of-the current economic downturn, according to economic analysts.

Sales for branded and private-label foods, respectively 79% and 21% of the packaged food market, have been steady, according to David Driscoll, an analyst for Citi Investment Research. This situation persists even though theFood Marketing Institute (FMI)predicts food prices will rise 5% this year (compared with 4.2% last year).

Food’s outlook is good partly because economic uncertainty leads consumers to cut down on dining out. According to a recent FMI report, 71% of survey respondents said they now eat out less often and more at home. Food consumed at home has a price advantage over restaurant food even despite rising costs for transportation, ingredients and packaging, making it attractive in recessionary times. The S&P Packaged Foods Index, while down about 5% from last October, is doing better than the S&P 500, which is down about 8%.

Private-label products are not necessarily taking advantage of the weaker economy. Christopher Growe, an analyst with Stifel Growe, says private label is subject to the same price pressures for ingredients, packaging and fuel and branded products. In fact, Growe said, their prices are rising faster than branded foods, which is leading to a small narrowing of the price gap between the two.

ConAgra, one of Driscoll’s top food company stock recommendations, is a good example of how branded companies are coping with the economic situation. ConAgra recently raised prices an average of 5% across 95% of its product portfolio, a reaction to higher costs for ingredients and other supplies. Nonetheless, ConAgra has kept its earnings forecasts at the current level of $1.80 to $1.85 a share, and has announced it expects per-share earnings to increase 8% to 10% over the long term.

It’s good news for branded food manufacturers, after months of resisting price increases, that the world won’t end if they finally do raise prices. The large branded companies have had private label breathing down their neck for years, but now everyone is facing the same price increases for ingredients and packaging. In fact, the branded people may have a slight edge here, because they always have the option of cutting back a bit on marketing expenditures. Ingredients and packaging make up a larger share of the cost of private-label goods; increases in their cost can’t be as readily absorbed.

Top Developments

Kraft revenue up, but earnings downKraft Foods reported net earnings of $608 million for the first quarter of 2008, a 13.4% decrease from the same period in 2007, despite net revenues of $10.4 billion, a 20.8% increase over 2007. Kraft is being squeezed by a general increase in commodity prices, but this is partially offset by its ability to pass along price increases to the consumer. This ability is helped by Kraft’s portfolio of mid-range products, which become an attractive alternative in tough economic times, says Christopher Shanahan, research analyst for Frost & Sullivan’s Chemicals, Materials and Food group: “This may be due to many consumers with very limited budgets buying more boxed macaroni and cheese as opposed to other higher quality food products.”

Frito-Lay downsizes products, raises prices

Due to the increasing prices of corn, cooking oil and energy, Frito-Lay Inc. is pouring up to one ounce of food less in some of its larger bags of potato chips and other savory snacks to delay a price hike. The company has also raised prices on some higher-priced items, but not on downsized items. The Snack Food Association will discuss commodities prices with members of Congress and U. S. Department of Agriculture this month.

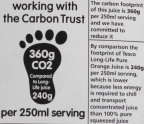

British grocer Tesco has begun labeling some of its store-brand products to show carbon footprint, in a format similar to nutritional labeling. Retailers who use the labels must commit to reducing their carbon impact over a two-year period. According to research by UK snack food manufacturer Walkers, which has carried the labels for a year, 70% of consumers said the labels made them more environmentally aware.

Correction:In our last issue, a Top Development mistakenly bore the headline, “Tyson to drop ‘hormone-free’ advertising.” The headline should have read, “Tyson to drop ‘antibiotic-free’ advertising.”Food Packaging Insightsregrets the error.

New Packages

Ragú moves into single-serve pouchesRagú pasta sauce, a mainstay brand from Unilever, is now available in a microwavable single-serve pouch. The 13.5-ounce Ragú Fresh & Simple pouch features a clear bottom gusset that allows consumers to view the product. Consumers clip open one corner of the pouch, microwave it for about a minute and a half, and hold it by the other corner to pour onto pasta.

Kraft Foods unveiled this week a major packaging variation for its iconic Cool Whip dessert topping: putting it into an aerosol for the first time. Up to now, the product had only been available frozen in plastic tubs. At the Food Marketing Institute show in Las Vegas, Kraft revealed the new aerosol, which features a plastic overcap shaped like a dollop of Cool Whip. The slim can holds 7 ounces of product and has a push-button nozzle. Three varieties (Regular, Lite and Extra Creamy) will be available in the cans, which are being shipped to retailers’ refrigerated cases this month with a suggested retail price of $2.79.