“What’s happening today is that you now have commodity plastics materials at historical high price levels that we’ve never seen before,” says Howard Rappaport, global practice leader for plastics and polymers at consulting firm Chemical Market Associates Inc.

Recent plastic resin supplier price hikes include:

• Dow Chemical raised polyethylene (PE) prices 5 cents a pound in June and scheduled another 7-cent hike for July.

• BASF increased the price of Styrolux, its clear styrene-butadiene copolymer, by 6 cents per pound in August, on top of a previous increase in July.

• LyondellBasell Industries increased prices on all of its polypropylene (PP) compound grades in Asia Pacific by 15 cents per pound.

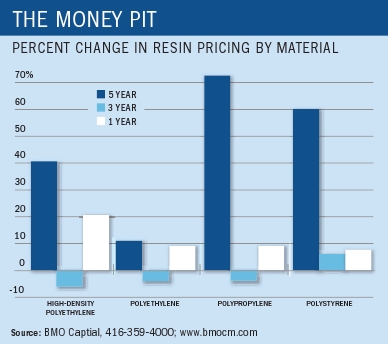

The spike in plastic resin prices is the cap on a long-term trend. According to BMO Capital Markets, five-year price hikes for major resins ranged from about 12% for polyethylene terephthalate (PET) to a whopping 70% for polypropylene.

So far, resistance to price hikes is following the classic pattern, according to Rappaport: The closer you get to the store shelf, the stiffer the resistance. The first-line converters who make resin into film, and the second-line converters who print and otherwise prepare it for the end user, have been eating the price increases in part or in whole.

Similar price hikes are going on with fiber-based materials like corrugated. According to a recent survey of corrugated container producers nationwide by investment research firm Longbow Research, all eight major North American containerboard producers, representing about 76% of North American containerboard industry capacity, announced a containerboard price hike of $55 per ton effective July 1. The report noted that although a similar price initiative in March failed, stronger demand this summer would make this one stick, according to a majority of container producers. In the wake of those price hikes, International Paper and Smurfit-Stone Container have both announced plans to raise prices for corrugated containers.

But there’s a fundamental difference between the plastic and fiber packaging markets. The latter is far more consolidated, meaning that converters can make price hikes stick more easily.

Nonetheless, with raw material prices continuing to increase, a pass-along may be inevitable, Rappaport says: “At some point there will have to be some degree of movement on the store shelf to reflect higher costs, because they are significant and we are at historical high levels for all these raw materials.”

BMO Capital Markets

416-359-4000

Chemical Market Associates Inc.

281-531-4660

Longbow Research

216-986-0700