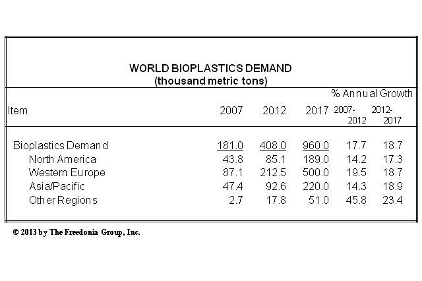

Global demand for biobased and biodegradable plastics will rise 19% per year to 960,000 metric tons in 2017. The bioplastics industry, while still in the emerging growth phase, has established itself as a fixture in a number of commercial markets and applications. According to analyst Kent Furst, “Robust growth in demand is expected in virtually all geographic markets,” driven by consumer preferences for sustainable materials, the increased adoption of bioplastics by plastic processors and compounders, and new product developments which expand the range of applications for bioplastics. However, despite the rapid rise in demand, bioplastics are still expected to account for less than one percent of the overall plastic resin market in 2022. Mr. Furst found, “The success of the bioplastics industry will ultimately depend on price and performance considerations, and large scale conversion to bioplastics will not occur until price parity with conventional plastic resins is achieved.” These and other trends are presented in World Bioplastics, a new study from The Freedonia Group, Inc. (freedonia.com), a Cleveland-based industry market research firm.

Starch-based resins and polylactic acid (PLA) will remain the leading bioplastic products through 2017, combining to account for over 60% of demand. For starch-based resins, advances will be bolstered by increased regulation of conventional plastic products, particularly plastic bags. PLA demand will benefit from the development of resins and compounds with enhanced performance attributes, suitable for more durable applications such as fibers, automotive parts, and electronic components. The most rapid gains in demand, however, are expected for biobased commodity resins such as polyethylene and polypropylene, which are just beginning to enter the commercial market.

Western Europe was the largest regional consumer of bioplastics in 2012, accounting for over half of global demand. The region will see strong gains through 2017 as well, bolstered by added regulations and incentives which favor bioplastics over conventional resins. North America will also register strong advances, with demand in the region expected to more than double, driven by rising consumption of PLA and biobased commodity resins. Advances in the Asia/Pacific region will be fueled by robust growth in China, which has become a major consumer of bioplastic resins used to produce manufactured goods for export.